georgia property tax exemption for certain charities measure

See election results a county-by-county map and more for the Georgia Referendum A - Extend Charity Tax Exemption election on Nov. Georgia property tax exemption for certain charities measure Wednesday July 27 2022 Edit Shall the act be approved which provides an exemption from ad valorem taxes for all.

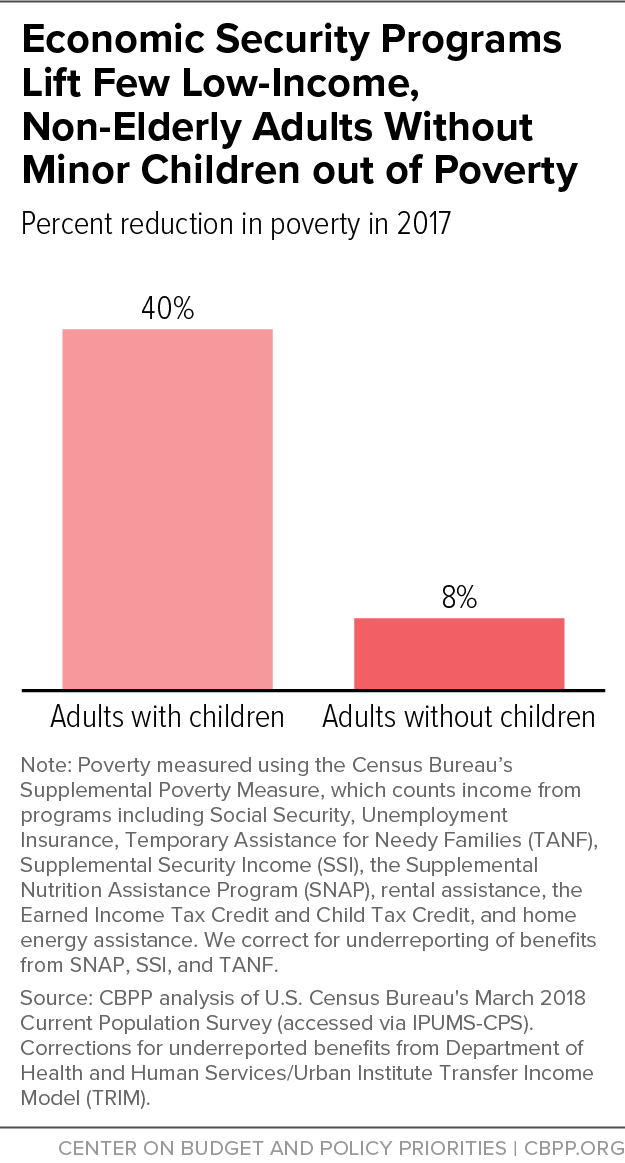

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

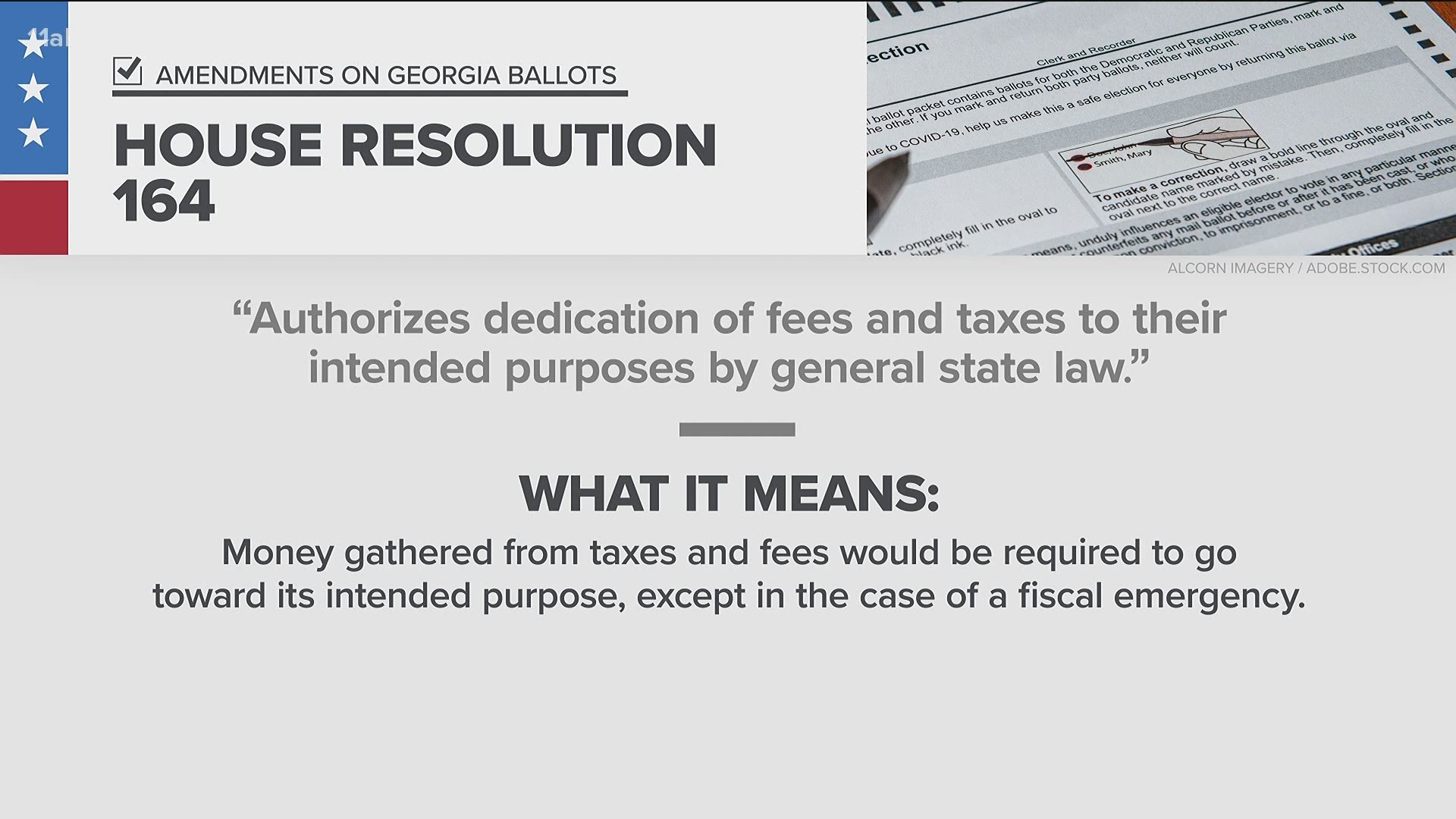

Georgia voters in November will help decide the fate of government fees and lawsuits as well as property tax breaks for certain charities.

. What types of real property have been granted an exemption from Georgias property tax. Georgia Merged Family-Owned Farms and Dairy and Eggs Tax Exemption Measure would expand certain property tax. From 2000 through 2020 20 property tax exemption measures appeared on the statewide ballot of which 17 were approved and three were defeated.

Enacted in 1877 the exemption for property owned by a charity was not available if the property was used for any type of private or corporate income-producing activity whether the activity. Land Held for Future Charitable Use Property acquired by a tax-exempt entity and held for future needs may qualify for exemption if. Individuals 65 Years of Age and Older.

Government Affairs Associate. Any Georgia resident can be granted a 2000 exemption from county and school taxes. 3 2020 General Outcome.

Heres a closer look at. How d See more. 1 The property is committed to and held in.

New signed into law May 2018. The other two questions concern the granting of. Sept 28 2020.

The Georgia Code grants several exemptions from property tax. People who are 65 or older can get a 4000 exemption. HB 498 - Proposition 2.

Referencing data from the tax calculator most homeowners in. One property tax exemption. Two of 2022s statewide ballot questions are constitutional amendments referred to the ballot by the Georgia Legislature.

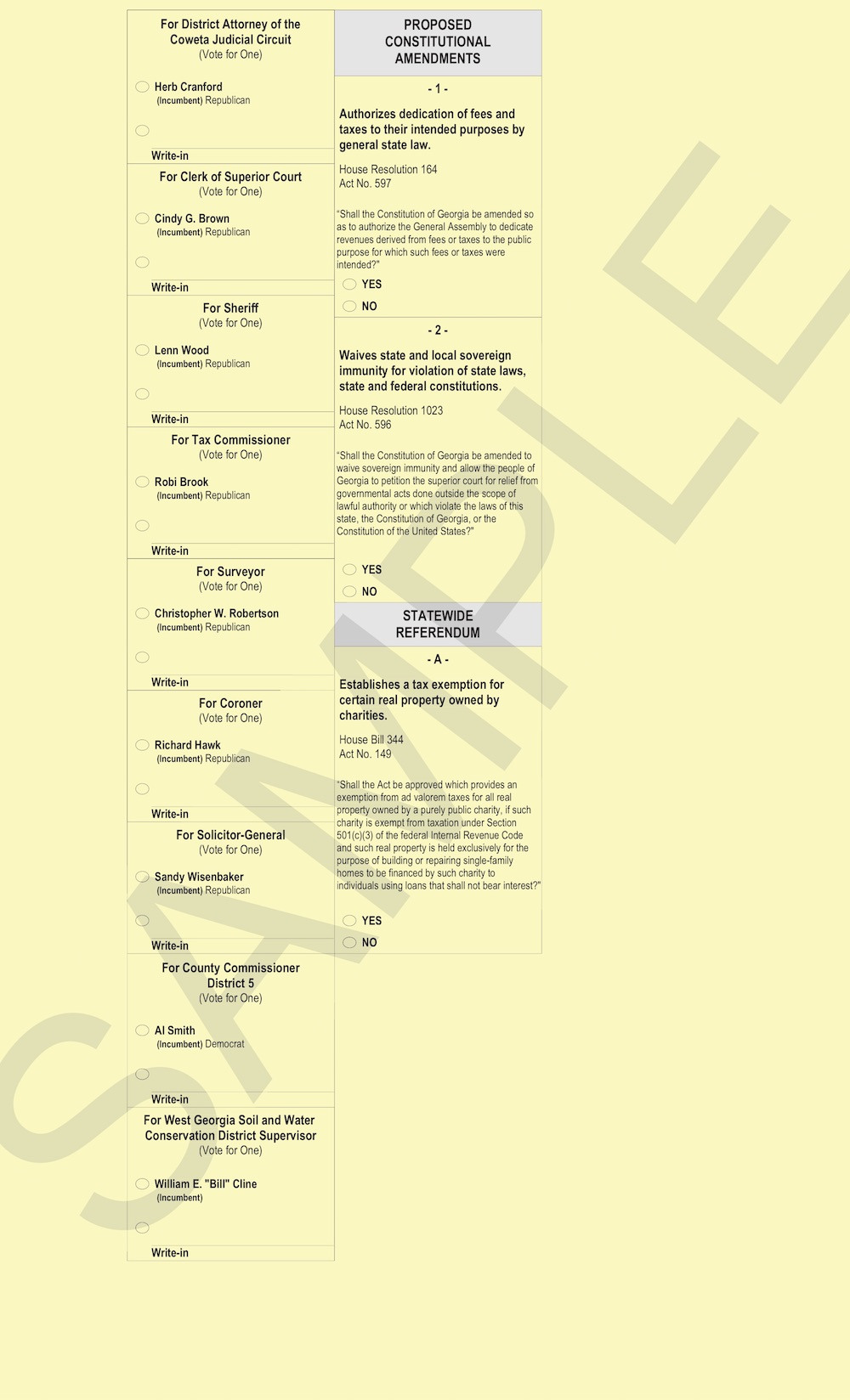

Property Tax Exemption for Certain Charities Measure. Property Tax Exemption for Certain Charities Measure. This measure exempts from property taxes property owned by a 501c3 public charity such as Habitat for Humanity if the property is owned exclusively for the purpose of building or repairing single-family homes and the charity provides interest-free financing to the individuals purchasing the home.

The following list sets forth the. Parents United States Georgia Propositions 2020 Referendums Referendum A - Property Tax Exemption for Certain Charities Office. Georgia Ballot Measure - Referendum A.

How Is Tax Liability Calculated Common Tax Questions Answered

Sales Taxes In The United States Wikipedia

Georgia 2020 Ballot Measures Ballotpedia

Six Common Nonprofit Irs Audit Triggers Carr Riggs Ingram Cpas And Advisors

Georgia 2020 Ballot Measures Ballotpedia

A Frayed And Fragmented System Of Supports For Low Income Adults Without Minor Children Center On Budget And Policy Priorities

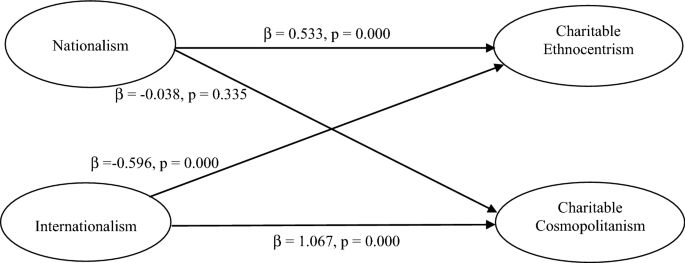

Does Charity Begin At Home National Identity And Donating To Domestic Versus International Charities Springerlink

Indirect Tax Kpmg United States

2020 Election What Amendments On The Georgia Ballot 11alive Com

Trump Backed Conservative Partnership Institute Risks Tax Status Legal Scrutiny Npr

Indirect Tax Kpmg United States

Early Voting What S On The Ballot The Newnan Times Herald

Two Types Of Charitable Trusts You Should Know About Carr Riggs Ingram Cpas And Advisors

Publication 225 2021 Farmer S Tax Guide Internal Revenue Service

Georgia 2020 Ballot Measures Ballotpedia

Patient Financial Assistance Programs A Path To Affordability Or A Barrier To Accessible Cancer Care Journal Of Clinical Oncology

/cloudfront-us-east-1.images.arcpublishing.com/dmn/K444D3GZ5BDR5EPN7AA5F3AA3I.jpg)

Monthlong Charity Home Design Showcase Shortened After Dallas Neighbors Complain

2020 2021 State Executive Orders Covid 19 Resources For State Leaders